How can I check on the status of my pending claim?

Can I check my pending claim status online?

How long will it take to receive a decision on my compensation claim?

Do I need to do anything if I have a claim or appeal pending with VA?

Can I have my claim reconsidered even though denied in the past?

Can I reopen a claim for disability compensation?

What if I have another disability not previously claimed?

How does VA determine the level of compensation payable?

Can I get back compensation payments?

What is the Board of Veterans’ Appeals?

Where do I file my appeal?

What is an appeal to the Board of Veterans’ Appeals?

Who can appeal?

When can I file an appeal?

What can I appeal to the Board?

What can’t I appeal to the Board?

How do I file an appeal?

What kind of information do I need to include in my appeal?

What SHOULD I do if you intend to appeal?

What should I AVOID?

Why Get a VA Loan Over Other Types?

What if I’ve Used a VA Home Loan Before?

What Service is Not Eligible for a VA Home Loan?

Do All Local Lenders Offer VA Loans?

What Types of Repayment Options are Available?

What is the Maximum VA Loan?

What is a VA-Guaranteed Manufactured Home Loan?

What Documents Do I Need to Provide the Lender To Receive a VA-Guaranteed Loan?

Who Is Eligible?

How Can I Apply?

Does a Veteran’s Home Loan Entitlement Expire?

Reservists are Eligible for VA Loans, Too. Who Qualifies?

Can a Veteran get a VA Farm Loan?

Can I Build a Home With a VA Home Loan?

Can You Take Out a VA Loan for a Second Home or Vacation Cabin?

Can a Veteran Obtain a VA Loan for the Purchase of Property in a Foreign Country?

If a Borrower has Used a VA Loan in the Past, Can That Person be Eligible Again?

I am a Veteran who Purchased a Home With my Spouse Utilizing my VA Eligibility. I am now Divorced and my Spouse was Awarded the Home. How do I Get my Eligibility Back?

I heard the VA has an Inventory of Foreclosed Homes. How can I Find out More About This?

DD214 QUICK FACTS

What Is a DD214?

Your DD214 is your proof of military service. It shows the nature of your discharge, dates of service, and current classification (retired, separated, Guard or Reserve status).When military members out-process as part of retirement or separation, getting the DD214 is one of the last things to happen after the briefings, equipment turn-in, and other clearances required as part of the “final out”. The DD214 is one of the most important documents you’ll get from that final out processing appointment-you need it to claim most, if not all, of your military benefits including VA loans, the GI Bill and medical services provided by the VA.

How do I get a replacement copy of my DD214?

You can request a FREE copy of your DD Form 214 simply by visiting the official United States Government site and filling out an online form.

There are 4 steps that you need to navigate. The system will guide you through the steps and tell you exactly which step you are on.

In Step 2 of the on-line request form, you will be asked to make selections from drop down menus about the nature of the request and the types of documents you are requesting. If these menus do not include the items you wish to request (for example, “all documents in the Official Military Personnel File”), you will have the opportunity to expand your request in the Comments section in Step 3. If you want to request multiple items from the menu selections in Step 2 (such as “Outpatient Treatment Records”, “Inpatient Treatment Records”, and “Mental Health Clinic Records”), choose one of the items from the menu and then use the Comments section in Step 3 to ask for the additional documents. Please do NOT create multiple, separate requests for each of the menu selections available in Step 2 as that may delay the handling of your request.

Print, sign and date the signature verification area of your customized form. If you don’t have a printer, have a pen and paper handy and we will guide you through the process. This is important because the Privacy Act of 1974 (5 U.S.C. 552a) requires that all requests for records and information be submitted in writing. Each request must be signed and dated by the veteran or next of kin.

If you are the next of kin of a deceased veteran, you must provide proof of death of the veteran such as a copy of death certificate, letter from funeral home, or published obituary.

Mail or fax your signature verification form (with proof of death, when applicable) to us, and we will process your request. You must do this within the first 20 days of entering your request, or your request will be removed from our system.

Who can request a copy of a DD214?

In order to use the online form you must be the service member or the service member’s next of kin.

The next of kin can be any of the following: surviving spouse that has not remarried, father, mother, son, daughter, sister, or brother.

If you are not the veteran or next of kin, you must complete the Standard Form 180 (SF 180). See Access to Military Records by the General Public for more details.

What information is required to obtain a copy of a DD214?

The information required to request a replacement copy of your DD214 includes the veteran’s Social Security Number, the branch of service, dates of military service, place of discharge and other vital information. The military member or the next of kin must authorize the form. If you’re filing on behalf of a deceased veteran, you must provide proof of death in the form of a death certificate, published obituary or other proof.

Should I ever pay for a copy of my DD214?

Do Not Pay For A DD214. Some companies offer to get your DD214 for a fee. While this is not technically illegal, it is misleading-the process for getting your DD214 isn’t as complicated as you might think and there’s nothing a third party can do to speed up the process. They only work on your behalf and spare you the paperwork for a fee many people feel is unreasonable once it’s known how simple requesting your DD214 actually is.

VA CLAIMS

How can I check on the status of my pending claim?

You can call 1-800-827-1000 and follow the recorded instructions, or you can contact the VA and fill out the Ask A Question form.

Can I check my pending claim status online?

You can use the eBenefits portal to check the status of your claim online if you are an eBenefits Premium (Level 2) account holder. To determine the status of your pending claim, login to your eBenefits account ( https://www.ebenefits.va.gov ) and select My eBenefits. On the “Compensation” tab, select Compensation & Pension Claims Status to view your claim status.

If you are not an eBenefits account holder, you can visit the eBenefits Registration page at https://www.ebenefits.va.gov/ebenefits-portal/ for information on how to establish an account.

How long will it take to receive a decision on my compensation claim?

The length of time it takes to receive a decision depends on several factors, such as the complexity of your disability(ies), the number of disabilities you claim, and the availability of evidence needed to decide your claim. Currently most claims are being processed within six months, but can take longer in complex claims.

Do I need to do anything if I have a claim or appeal pending with VA?

No, you do not have to do anything additional with regard to your pending claim or appeal.

Can I have my claim reconsidered even though denied in the past?

If you have new evidence to support your previously denied claim, you should send a written request to your VA regional office to have your claim reopened. Include the new supporting evidence (or information telling VA where the evidence can be obtained). You may use VA Form 21-4138, Statement in Support of Claim, to submit your written request.

Can I reopen a claim for disability compensation?

You are entitled to reopen your claim for disability compensation at any time for any condition(s) not previously claimed. VA will require current medical treatment records to support your claim. Also, if you are already service- connected for other physical ailments, you may request reevaluation of these conditions if they have worsened. You may submit your claim on blank paper stating the conditions, date the disability began, and where you were treated. VA will obtain your service medical records for those conditions treated in service. Conditions treated by private doctors will require an authorization release form. This process will begin when your claim is received. Please provide your VA claim number on all correspondence. If you have further questions, please feel free to call us toll free at 1-800-827-1000, Monday thru Friday, from 8:30 a.m. to 4:00 p.m. You may also file your claim in person with a Benefits Representative at your nearest VA office.

What if I have another disability not previously claimed?

If you have another disability that you feel is related to your military service, but you have not previously filed a claim for that disability, you may file a new claim by submitting a written request. VA Form 21-4138, Statement in Support of Claim, may also be used for this purpose.

You can find VA Form 21-4138 at:

http://www.vba.va.gov/pubs/forms/VBA-21-4138-ARE.pdf

To establish a new condition as service-connected, we will need any information you can provide that will help us link that condition to your military service. You should also submit current medical evidence. Be sure to include your VA claim number or Social Security number on all correspondence. Mail the completed form or other written request and any evidence you have to your VA regional office.

You may find the address for a VA regional office at:

http://www1.va.gov/directory/guide/division_flsh.asp?dnum=3

For all current information about compensation and pension, eligibility, payment rates, applications, etc., go to http://www.vba.va.gov/VBA/ and click on the applicable links.

How does VA determine the level of compensation payable?

Disability compensation is a monthly benefit paid to veterans because of injuries or diseases that happened while on active duty, or were made worse by active military service.

VA must obtain evidence to establish that the disability claimed is the result of the veteran’s military service. VA then evaluates the medical evidence and assigns a disability rating percentage.

VA evaluates each service-related condition in 10% increments. For some conditions, the maximum level of compensation is 100%. However, for most conditions, the maximum level of compensation is less than 100%.

Once the medical evidence is evaluated and a percentage rating assigned, VA pays the amount of compensation provided by law for that rating.

For current information about compensation, eligibility, payment rates, applications, etc., go to http://www.vba.va.gov/VBA/ and click on the applicable links.

Can I get back compensation payments?

Generally, VA can only pay benefits based on the date of claim. This applies in the case of an original claim, a claim for an increased evaluation, or a claim to add a new disability.

If VA finds a clear error was made in an earlier decision, you may receive additional back pay based on that prior claim.

For all current information about compensation and pension, eligibility, payment rates, applications, etc., go to http://www.vba.va.gov/VBA/ and click on the applicable links.

VA CLAIMS APPEAL PROCESS

What is the Board of Veterans’ Appeals?

The Board of Veterans’ Appeals (also known as “the BVA” or “the Board”) is a part of the Department of Veterans Affairs (VA), located in Washington, D.C. “Members of the Board” review benefit claims determinations made by local VA offices and issue decisions on appeals. These Board members, attorneys experienced in veterans’ law and in reviewing benefit claims, are the only ones who can issue Board decisions. Staff attorneys, referred to as Counsel or Associate Counsel, are also trained in veterans’ law. They review the facts of each appeal and assist Board members.

Where do I file my appeal?

Normally, you file your appeal with the same local VA office that issued the decision you are appealing, because that is where your claims file (also called a claims folder) is kept. However, if you have moved and your claims file is now maintained at a local VA office other than the one where you previously filed your claim, you should file your appeal at the new location.

What is an appeal to the Board of Veterans’ Appeals?

An appeal is a request for a review of a VA determination on a claim for benefits issued by a local VA office.

Who can appeal?

Anyone who has filed a claim for benefits with VA and has received a determination from a local VA office is eligible to appeal to the Board of Veterans’ Appeals.

When can I file an appeal?

You may file an appeal up to one year from the date the local VA office mails you its initial determination on your claim. After that, the determination is considered final and cannot be appealed unless it involved clear and unmistakable error by VA.

What can I appeal to the Board?

You may appeal any determination issued by a VA regional office (RO) on a claim for benefits. Some determinations by VA medical facilities, such as eligibility for medical treatment, may also be appealed to the Board. You may appeal a complete or partial denial of your claim or you may appeal the level of benefit granted. For example, if you filed a claim for disability and the local office awarded you a 10% disability, but you feel you deserve more than 10%, you may appeal that determination to the Board.

What can’t I appeal to the Board?

Decisions concerning the need for medical care or the type of medical treatment needed, such as a physician’s decision to prescribe (or not to prescribe) a particular drug or order a specific type of treatment, are not within the Board’s jurisdiction. (Occasionally, the Board receives an appeal of this nature, but since it doesn’t have the legal authority to decide this type of case, the Board must dismiss it.)

How do I file an appeal?

No special form is required to begin the appeal process. All that’s needed is a written statement that (1) you disagree with your local VA office’s claim determination and (2) you want to appeal it. This statement is known as the Notice of Disagreement, or NOD.

What kind of information do I need to include in my appeal?

It is important that you send VA any evidence that supports your argument that its determination on your claim was wrong. If you have additional evidence, such as records from recent medical treatments or evaluations that you feel make your case stronger, you can submit the evidence to the office holding your claims folder. An appeal representative can also submit additional written information in support of your claim.

If your file is still at the local VA office and you send your new evidence there, it will send you a SSOC if it still does not allow your claim after reviewing the new evidence. The new evidence you submitted will be included in your claims folder and considered when th Board reviews your appeal.

If you want the Board to consider your new evidence without sending your case back to the local VA office, include a written statement saying that you waive local VA office consideration of your new evidence and that you want the Board to review the evidence even though the local VA office hasn’t seen it. Otherwise, there could be a considerable delay while the Board sends your new evidence back to the local VA office to consider.

How do I file an appeal?

No special form is required to begin the appeal process. All that’s needed is a written statement that (1) you disagree with your local VA office’s claim determination and (2) you want to appeal it. This statement is known as the Notice of Disagreement, or NOD.

What kind of information do I need to include in my appeal?

It is important that you send VA any evidence that supports your argument that its determination on your claim was wrong. If you have additional evidence, such as records from recent medical treatments or evaluations that you feel make your case stronger, you can submit the evidence to the office holding your claims folder. An appeal representative can also submit additional written information in support of your claim.

If your file is still at the local VA office and you send your new evidence there, it will send you a SSOC if it still does not allow your claim after reviewing the new evidence. The new evidence you submitted will be included in your claims folder and considered when th Board reviews your appeal.

If you want the Board to consider your new evidence without sending your case back to the local VA office, include a written statement saying that you waive local VA office consideration of your new evidence and that you want the Board to review the evidence even though the local VA office hasn’t seen it. Otherwise, there could be a considerable delay while the Board sends your new evidence back to the local VA office to consider.

What SHOULD I do if you intend to appeal?

- Do consider having an appeal representative assist you.

- Do file your appeal and VA Form 9 as soon as you’re sure you want to appeal. (Because so many appeals are filed, delaying could add months to your wait for the Board’s decision.)

- Do be as specific as possible when identifying the issue or issues you want the Board to consider.

- Do be specific when identifying sources of evidence you want VA to obtain. For example, provide the full names and addresses of physicians who treated you, when they treated you, and for what they treated you.

- Do keep VA informed of any change to your current address, phone number, or number of dependents.

- Do be aware that copies of your doctor’s treatment records are generally more helpful than just a statement from the doctor.

- Do be clear (on your VA Form 9) about whether or not you want a BVA hearing and where you want it held.

- Do provide all the evidence you can that supports your claim, including additional evidence or information requested by VA.

- Do include your claim number on any correspondence you send to VA and have it ready if you call. This helps VA find your records.

What should I AVOID?

- Don’t try to “go it alone.” Consider getting a representative. A skilled representative can save you a lot of time, help you prepare the best possible appeal, and help you avoid mistakes.

- Don’t send in material that doesn’t have anything to do with your claim or send duplicates of things you have already sent to VA. This will only slow down the process.

- Don’t use the VA Form 9 to raise new claims for the first time. The VA Form 9 is only used to appeal decisions on previously submitted claims.

- Don’t use the VA Form 9 to request a local office hearing. Write to that office instead.

- Don’t raise additional issues for the Board to consider late in the appeal process, especially after your claims folder has been sent to the Board in Washington, D.C. This could well cause your case to be sent back to your local VA office for additional work and result in a longer wait for a BVA decision.

- Don’t submit evidence directly to the Board unless you include a written or typed statement saying that you waive consideration of the new evidence by the local VA office and clearly indicating that you want the Board to review the evidence even though the local VA office has not seen it. If you submit evidence directly to the Board without such a waiver, the case may be remanded for review and could result in delays.

- Don’t submit a last minute request for a hearing or a last minute change to the type or location of a hearing unless it is unavoidable. This almost always results in a delay in getting a final decision.

VA HOME LOANS

Why Get a VA Loan Over Other Types?

Simply put, a VA Home Loan allows qualified buyers the opportunity to purchase a home with no down payment. There are also no monthly mortgage insurance premiums to pay, limitations on buyer’s closing costs, and an appraisal that informs the buyer of the property value. For most loans on new houses, construction is inspected at appropriate stages and a 1-year warranty is required from the builder. VA also performs personal loan servicing and offers financial counseling to help veterans having temporary financial difficulties.

What if I’ve Used a VA Home Loan Before?

You can have previously-used entitlement “restored” one time only in order to purchase another home with a VA loan if the borrower has paid off the prior loan but still owns the property, and wants to use his entitlement to purchase a second home. This often occurs with active duty borrowers who PCS to a new station but want to keep their existing home for retirement. However if the prior loan has been paid off, AND the property is no longer owned, they can have their entitlement restored as many times as they want. They can re-use their VA eligibility for every home purchase from the first to the last.

Also, veterans who have used a VA loan before may still have remaining entitlement (see chart) to use for another VA loan. A veteran’s maximum entitlement is $89,912, and lenders will generally loan up to four times your available entitlement without a down payment, provided your income and credit qualifications are fine, and the property appraises for the asking price. Lenders may require that a combination of the guaranty entitlement and any cash down payment must equal at least 25 percent of the reasonable value or sales price of the property, whichever is less.

For Alaska, Hawaii, Guam, and U.S. Virgin Islands? residents, note that maximum original loan amounts have now been increased 50 percent higher for first mortgages.

Remaining entitlement and restoration of entitlement is not automatic. It can be requested through the nearest VA office by completing VA Form 26-1880. The entitlement may also be restored one time only if the veteran has repaid the prior VA loan in full but has not disposed of the property purchased with the prior VA loan.

What Service is Not Eligible for a VA Home Loan?

You are not eligible for VA financing solely based upon service in World War I, Active Duty Training in the Reserves, or Active Duty Training in the National Guard. Note: Guard and Reservists are eligible if they were “activated” under the authority of title 10 U.S. Code as was the case for the Iraq / Afghanistan.

Do All Local Lenders Offer VA Loans?

Not necessarily. Choose a VA-approved lending institution that can handle your home loan. A lender can help you review your credit history and determine how much of a loan you can qualify for. Be aware that different lenders have different closing costs and other fees, so it pays to shop around.

What Types of Repayment Options are Available?

The guarantees thirty-year loans with a choice of repayment plans: Traditional fixed payment (constant principal and interest); Graduated Payment Mortgage, or GPM (low initial payments which gradually rise to a level payment starting in the sixth year); and in some areas, Growing Equity Mortgages, or GEMs (gradually increasing payments with all of the increase applied to principal, resulting in an early payoff of the loan). There is no prepayment penalty.

What is the Maximum VA Loan?

Although there is no maximum VA loan (limited only by the reasonable value or the purchase price), lenders generally limit the maximum VA loan to $417,000.

What is a VA-Guaranteed Manufactured Home Loan?

A VA-guaranteed loan can be used to:

- buy a home, a manufactured home, or a condominium

- buy a lot for a manufactured home

- build, repair, or improve a home (including energy efficient improvements)

- refinance an existing loan

A VA-guaranteed loan offers a number of safeguards and advantages over a non VA-guaranteed loan. For example, the interest rate is competitive with conventional rates with little or no down payment required. VA-guaranteed loans are made by private lenders, such as banks, savings and loan associations, and mortgage companies. As with any loan, you must apply directly to the lender. Your real estate broker can assist you in finding a lender.

When the loan is approved, VA will guarantee part of it. The amount of VA’s guaranty usually depends on the size of the loan. This guaranty protects the lender against loss up to the amount guaranteed by VA. The largest guaranty that VA can give is an amount equal to 25% of the Freddie Mac conforming loan limit for single-family residences. These limits are subject to change each year.

What Documents Do I Need to Provide the Lender To Receive a VA-Guaranteed Loan?

The lender will need a Certificate of Eligibility to prove that you are eligible for a VA-guaranteed loan. Certificates are issued by VA’s Loan Eligibility Center in Winston-Salem, North Carolina to eligible persons who apply for the certificate. Often times, your lender may be able to access VA’s secure web site and obtain a certificate for you.

You can also get a Certificate of Eligibility (COE) in any of three ways:

1. Apply Online

Go to eBenefits online and select the Log I link under the Housing section on the bottom right. You will need login credentials to request a Certificate of Eligibility (COE). If you need to request login credentials, you can simply click on the “Request/Activate a DoD Self-Service Login” link below the login area.

2. Apply Through the Lender

Your lender can submit your application online for you. Click here for a list of evidence you will need to apply.

3. Apply by Mail

Use VA Form 26-1880. If you can’t print the form, just call 1-888-768-2132 and follow the prompts for Eligibility. We can mail it to you.

Who Is Eligible?

Generally, the following persons are eligible:

- Veterans who were discharged since 9/16/40, under other than dishonorable conditions

- Military personnel on active duty who have served a minimum period

- Certain Reservists and National Guard members

- Surviving spouses of certain deceased veterans

Note: There are certain other groups of individuals who may be eligible. For information about these groups, contact VA at the toll-free number below.

Contact the VA toll free at: 1-800-827-1000

How Can I Apply?

You can apply by requesting your lender to obtain a certificate for you through VA’s secure web site OR by completing one of the following forms and submitting it to the Loan Eligibility Center in Winston-Salem, North Carolina.

- Veteran / Servicemember: VA Form 26-1880, Request for a Certificate of Eligibility for VA Home Loan Benefits

http://www.vba.va.gov/pubs/forms/VBA-26-1880-ARE.pdf

- Surviving Spouse: VA Form 26-1817, Request for Determination of Loan Guaranty Eligibility – Unmarried Surviving Spouse

http://vbaw.vba.va.gov/bl/20/cio/20s5/forms/VBA-26-1817-ARE.pdf

For More Information, Call Toll-Free 1-888-244-6711 or Visit Our Web Site at:

http://www.homeloans.va.gov/eligibility.htm

Does a Veteran’s Home Loan Entitlement Expire?

No. Home loan entitlement is generally good until used if a person is on active duty. Once discharged or released from active duty before using an entitlement, a new determination of their eligibility must be made based on the length of service and the type of discharge received.

Reservists are Eligible for VA Loans, Too. Who Qualifies?

Eligibility extends to members who have completed a total of 6 years in the Selected Reserves or National Guard (member of an active unit, attended required weekend drills and 2-week active duty for training) and received an honorable discharge; continue to serve in the Selected Reserves. Individuals who completed less than 6 years may be eligible if discharged for a service- connected disability. In addition, reservists and National Guard members who were activated on or after August 2, 1990, served at least 90 days and were discharged honorably are eligible.

Can a Veteran get a VA Farm Loan?

No, except for a farm on which there is a farm residence that will be personally occupied by the veteran as a home. Other types of farm financing may be obtained through the Farmers Home Administration.

Can I Build a Home With a VA Home Loan?

Yes. But there are several clauses that may make this difficult to accomplish. Many veterans use their VA Home Loan Certificate of Eligibility to negotiate in good faith a private home construction loan and then refinance the completed home using VA Home Loans.

Can You Take Out a VA Loan for a Second Home or Vacation Cabin?

The law requires that you certify that you intend to occupy the property as your home. But it specifically provides that occupancy by the veteran’s spouse satisfies the personal occupancy requirement. However, there are no provisions for other family members. VA Home Loans are available for a variety of purposes including building, altering, or repairing a home; refinancing an existing home loan; buying a manufactured home with or without a lot; buying and improving a manufactured home lot; and installing a solar heating or cooling system or other weatherization improvements. You are also allowed to buy income property consisting of up to four units, provided you occupy one of the units.

Can a Veteran Obtain a VA Loan for the Purchase of Property in a Foreign Country?

No. The property must be located in the United States, its territories, or possessions. The latter consist of Puerto Rico, Guam, Virgin Islands, American Samoa and Northern Mariana Islands.

If a Borrower has Used a VA Loan in the Past, Can That Person be Eligible Again?

Veterans who had a VA loan before may still have “remaining entitlement” to use for another VA loan. The current amount of entitlement available to each eligible veteran is $36,000. Veterans can have previously-used entitlement “restored” to purchase another home with a VA loan if: the property purchased with the prior VA loan has been sold and the loan paid in full, or if a qualified veteran buyer agrees to assume the VA loan and substitute his or her entitlement for the same amount of entitlement originally used by the veteran seller. The entitlement may also be restored one time only if the veteran has repaid the prior VA loan in full, but has not disposed of the property purchased with the prior VA loan.

I am a Veteran who Purchased a Home With my Spouse Utilizing my VA Eligibility. I am now Divorced and my Spouse was Awarded the Home. How do I Get my Eligibility Back?

When the property is awarded to the Veteran’s spouse as a result of the divorce, entitlement cannot be restored unless the spouse refinances the property and / or pays off the VA loan in full or the ex-spouse is a veteran who substitutes their entitlement.

I heard the VA has an Inventory of Foreclosed Homes. How can I Find out More About This?

The Department of Veterans Affairs (VA) acquires properties as a result of foreclosures on VA guaranteed loans. These acquired properties are marketed through a property management services contract with Ocwen Federal Bank FSB, West Palm Beach, Florida. Local listing agents through local Multi Listing Systems (MLS) list the properties. A list of properties for sale may also be obtained from Ocwen’s website at http://www.ocwen.com/ .

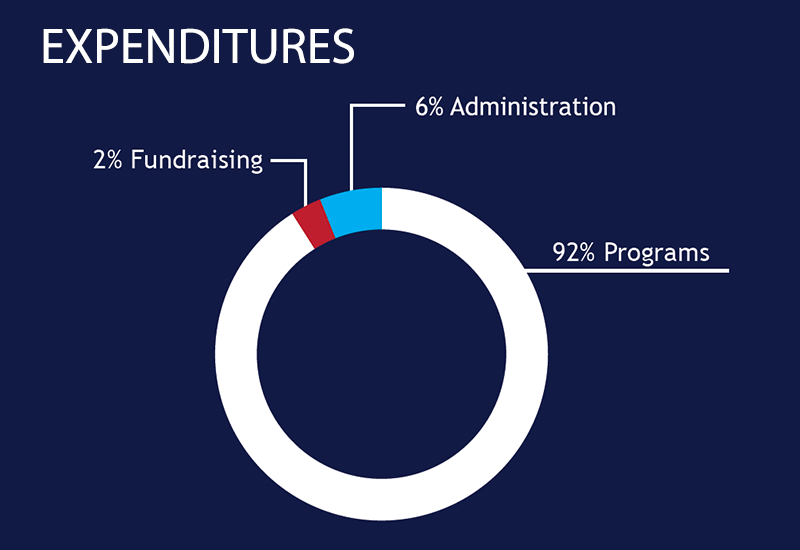

92% of every donation directly supports our Veteran Community!

NEWSROOM

CONTACT US

The Veterans Multi-Service

Center Headquarters

213-217 N. 4th Street

Philadelphia, PA 19106

P: 215-923-2600

F: 215-925-8460

Hours: M-F, 8:30am to 4:30pm

See all locations

Media Contacts

The VMC is a non-profit 501 (c)(3) organization | EIN/Tax ID: 23-2764079 | United Way Donor Option #14797419 | CFC Donor Option #48126